Expiry Futures Trading in Singapore, on OKX: What It Is, How It Works, and What to Know

Expiry Futures are crypto derivatives that let you trade an asset’s future price with a key difference:

They come with a fixed settlement date.

This means your open position will automatically settle at expiration (unless you close it earlier), based on the contract’s terms. These products are designed for traders with clear market outlooks and strategic timeframes, such as institutions or advanced users running hedge strategies.

Feature | Perpetual Swaps | Expiry Futures |

|---|---|---|

Expiry | No expiry. Open/close anytime | Fixed expiry date. Auto-settles if not closed |

Funding Costs | Periodic funding fees | No funding fees |

Best For | Short-term trading, high flexibility | Long-term positions, hedging strategies |

Liquidation Risk | Margin-based. Positions can close any time | Less volatile for longer-term expiries |

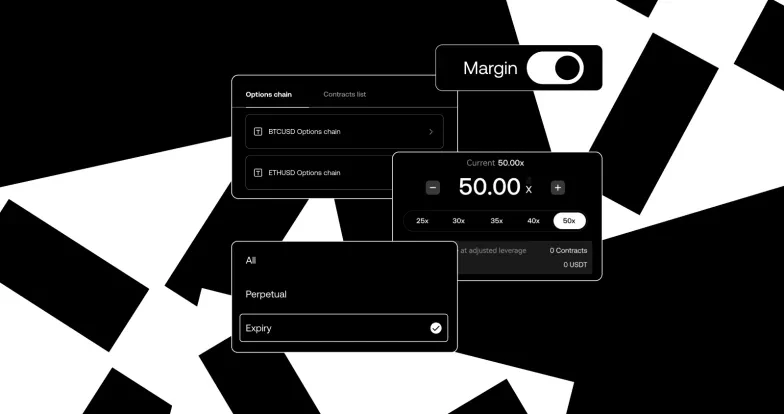

Leverage | Up to 50x | Up to 20x |

Benefits of Expiry Futures

Predictable structure for long-term positions

No ongoing funding fees like perps

Ideal for hedging exposure or expressing macro market views

Available in weekly, bi-weekly, quarterly contracts

Access up to 20× leverage on supported pairs

In summary, Expiry Futures offer a structured, time-based way to trade or hedge crypto markets.They’re ideal for investors with a clear view on price over time, be it it’s one week out or a full quarter.You get:

Predictable expiry and settlement

No hidden costs from funding rates

The ability to trade up or down, with leverage

Read more about the expiry futures contract generation here.

Expiry Futures trading is currently available only to Accredited Investors in Singapore. Verify as an Accredited Investor now, and gain access to Spot Margin